The Shibainu (SHIB) derivatives market has seen reduced activity over the past few weeks. This was reflected in a decline in futures open interest, which fell to its lowest level since February 14.

This drop was due to a drop in meme coin prices. At the time of writing, SHIB is trading at $0.000014, with the last price level reached on March 1.

Impact of Reduced Activity on SHIB Derivatives Market

According to Coinglass, SHIB’s futures open interest is $26 million. It has continued to fall since July 19, dropping by 51% in the past 16 days. Futures Open Interest reflects the total number of open futures contracts that have not yet been settled. A decline in this metric signals a decrease in market activity and interest in the underlying asset, often viewed as a bearish signal by traders.

However, despite the decline in futures open interest, SHIB dominates funding rates on cryptocurrency exchanges. This suggests that the lack of interest in memecoins may not be a widespread trend.

SHIB Price Forecast and Market Indicators

The Relative Strength Index (RSI) for SHIB on the 1-day chart currently stands at 29.03, indicating that the meme coin is oversold and a potential upward correction may be on the horizon. This suggests a possible price rebound in the near future.

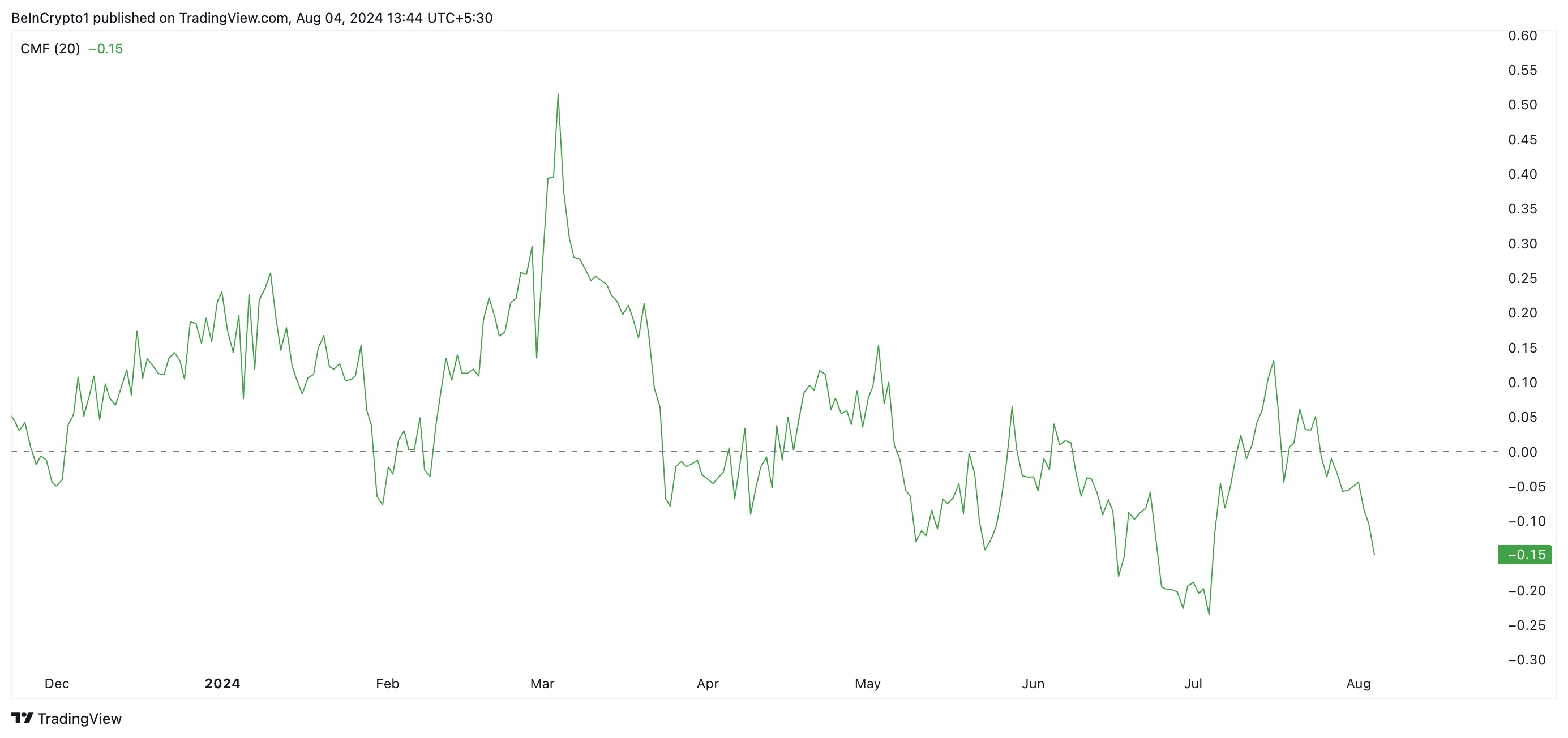

However, other indicators such as the Chaikin Money Flow (CMF) paint a different picture. SHIB’s CMF is currently -0.15, below zero, indicating a bearish trend. The CMF tracks the flow of money into and out of an asset, and a negative value suggests more outflow than inflow, reinforcing the bearish sentiment.

If the current bearish trend continues, SHIB’s price may drop to $0.000012, with the last trade at this level recorded on July 5. However, a rebound scenario could see the price surge to $0.000020, driven by increasing liquidity in the market.