BONK Price Analysis: Bullish Signals Emerging Amidst Recovering Futures Market

Bonk Leveraged Traders Pivot to Bullish Positions

One indicator that can provide a clear picture of a trader’s position is the funding ratio. This indicator is the cost of holding an indefinite position in the market and is a barometer of investor expectations.

When the funding ratio is positive, longs (buyers) pay commissions to shorts (sellers) and the average expectation is bullish. Conversely, negative funding rates mean short sellers expect prices to fall while paying fees to long positions.

As shown in the chart below, traders lined up short positions during an early bear market. However, as of press time, the price of BONK is higher than previous levels. Therefore, the funding situation turned positive, indicating that traders in the futures market hope to profit from the continued rise in prices.

Learn more: 11 Solana Meme Coins to Watch in August 2024

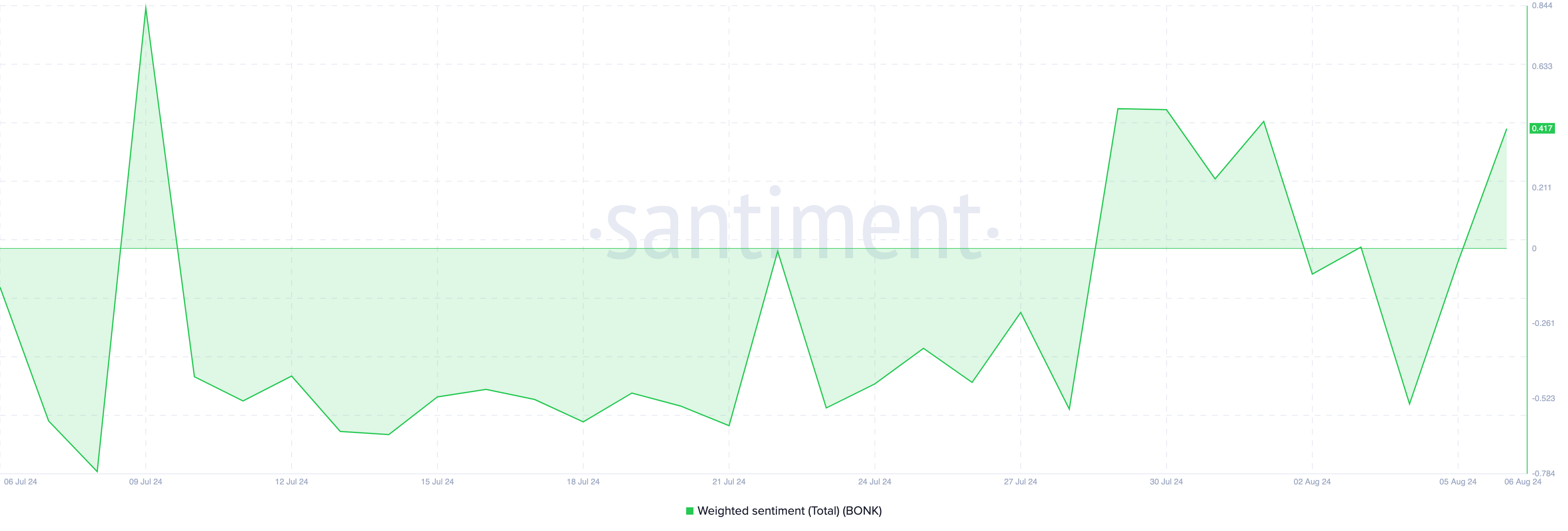

But futures traders aren’t the only ones changing their minds about meme coins. According to Santiment, Bonk’s weighted sentiment has moved out of negative territory and is now positive.

The weighted sentiment term uses social volume to measure market sentiment towards a cryptocurrency project. If the number is negative, it means that online reviews are mostly pessimistic. However, positive reviews like BONK’s suggest that optimism is growing.

BONK Price Prediction: Bullish Pattern Continues

If you look at the daily chart when BONK was trading at $0.000021, you can see that a cup-and-handle pattern has formed. This is a bullish continuation pattern that occurs when a cryptocurrency bottoms out, then experiences a downtrend, recovers, and then falls again.

However, as you can see in the BONK chart below, when the price breaks out of the downtrend, we can see a continuation of the bullish trend. If the buying trend increases, the BONK price may rise to $0.000025 in the future.

A successful move above this level could lead MEMCOIN towards the overhead resistance at $0.000029. However, traders may want to pay attention as the relative strength index (RSI), which measures momentum, has yet to break above the neutral line.

Read More: The Best Cryptocurrencies Scheduled for Airdrops in 2024

If the RSI breaks above 50.00, the bullish logic is confirmed, and the value of BONK will rise exponentially. However, if it fails to break above the 50.00 midpoint, the coin may remain stuck between $0.000019 and $0.000021.

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from the use of the information on this website.

In addition, part of the content is the AI translated English version of BeInCrypto articles.