The price of Ethereum (ETH) continues to recover due to increased demand in the ETF (Exchange Traded Fund) market. However, widespread market instability and institutional selling pressure remain a burden.

The cryptocurrency market continues to show changes in sentiment, with global market capitalization rising by nearly 3%.

Ethereum’s Phased Recovery

Ethereum’s price has soared nearly 30% since bottoming at $2,111 on August 5 due to continued recovery efforts. Looking at the daily chart, we see that the price and relative strength index (RSI) are making higher lows, indicating growing bullish momentum. If the RSI breaks above 50 decisively, this momentum may strengthen further.

The spike in the volume curve (orange) shows that bulls are waiting to interact with Ethereum price once it enters the demand zone between $2,924 and $3,075. Notably, this order block turned into a bearish breakout on August 3 when Ethereum price fell below it.

Learn More: Ethereum (ETH) Price Prediction 2024/2025/2030

Cryptocurrency market sentiment is changing as Bitcoin reclaims psychological support at $60,000 and global market capitalization rises 3%. On top of that, there’s been a boost from positive ETF flows, led by the Ethereum ETF.

Ethereum led inflows into cryptocurrency investment products last week, according to a report by BeInCrypto. It raised $155 million of the $176 million total.

“Ethereum has been the biggest beneficiary of the recent market correction, with inflows of $155 million last week. Driven by the recently launched U.S. spot ETF, inflows so far this year have reached $862 million, the highest level since 2021.

Reaction to Ethereum Price Changes

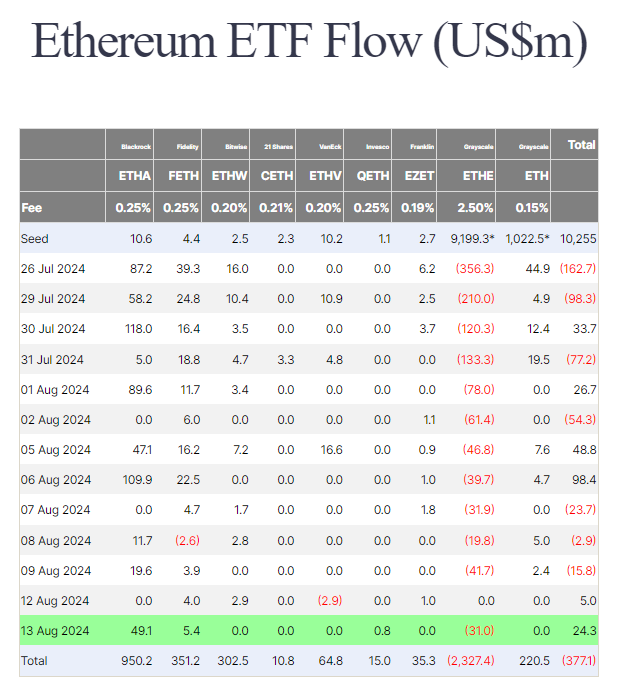

On Tuesday, the Ethereum spot ETF recorded net inflows of $24.34 million, exceeding the $5 million recorded on Monday. Farside Investors said that ETHA, a subsidiary of BlackRock, has seen a steady inflow of funds since its launch, demonstrating strong investor confidence.

Of this amount, ETHA received $49.1 million in inflows, totaling $950.2 million. On the other hand, Grayscale’s Ethereum continued to experience negative flows, with total outflows reaching US$2.327 billion. This reflects the conflicting performance of the two prominent Ethereum ETFs, and in Grayscale’s case was blamed for the Bitcoin customer redemptions that occurred last January.

“Institutions have invested in Bitcoin before. They are doing it again with Ethereum. They almost led people to believe that the BTC ETF failed. Almost the same story is repeating itself with Ethereum. We may be able to reverse the uptrend of this cycle and start over again Up, but until then it will be painful to watch the next generation of financial tracks go up in flames,” Vikas Singh expressed:

Learn more: How to Invest in Ethereum ETFs?

Still, while Ethereum ETF inflows are providing positive momentum for Ethereum, institutional selling is creating headwinds and having an offsetting effect. According to LookOnChain, Jump Trading started selling Ethereum again on Wednesday. The Chicago-based trading firm’s cryptocurrency arm staked 7,049 Ethereum worth $46.44 million from Lido Finance and sold them.

“Jump Trading just started selling Ethereum again! They requested 17,049 Ethereum ($46.44 million) from Lido for transfer sale. Jump Trading currently has 21,394 wstETH ($68.58 million) remaining.

BeInCrypto reported that the company requested more than 14,000 Ethereum redemptions on August 7, worth more than $48 million. On the same day, 11,500 Ethereum worth $29 million was unstaking from Lido Finance and transferred to the centralized exchange. Additionally, on August 5, over $231 million worth of Ethereum was sold.

Moving frozen assets to centralized exchanges often signals an intention to sell, which could put downward pressure on Ethereum prices. The sell-off in ETF investor demand has limited Ethereum’s upside potential below $2,800, where range-bound action is likely to occur.